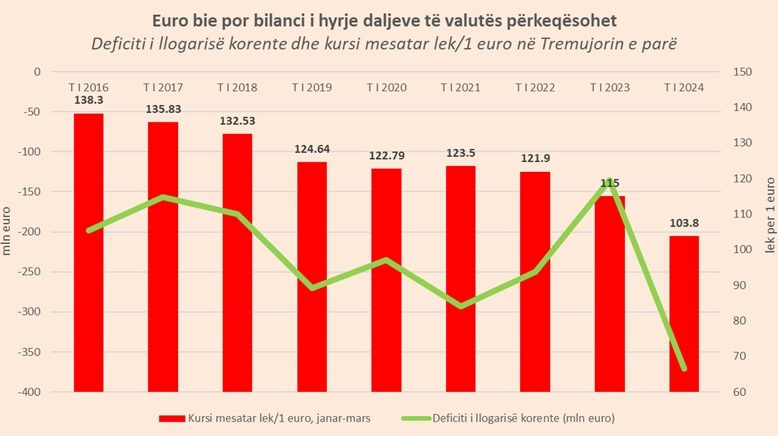

Despite reaching record lows, there has been less official euro currency inflow in Albania. In the first quarter of 2024, the average exchange rate of the euro against the lek reached 103.8 lek, the lowest level in history. Compared to the same period last year, when the euro was exchanged at an average of 115 lek, the common currency has depreciated by 9.7%, Monitor reports.

|

| Entry/Exit of the Euro currency in Albania from 2016 to 2024, source: Monitor |

Theoretical Implications of the Euro's Decline

Theoretically, the decline in the euro indicates that officially more foreign currency has entered the country and less has exited, thereby increasing the supply of the common currency. Sources of foreign currency inflow include exports, spending by foreign tourists, remittances from emigrants, and income from services. On the other hand, the biggest expense is the purchase of imported goods, which Albania is increasingly dependent on due to the difficulties faced by local production.

Discrepancy with Official Data

However, official data from the first quarter balance of payments, which measures foreign currency transactions in and out of the country, indicate that the figures do not explain the strengthening of the lek. The current account deficit saw a sharp increase in the first quarter of 2024, reaching the highest level ever recorded for this period of the year.

Statistics from the Bank of Albania show that the current account deficit reached -371 million euros, a 190% increase compared to the same period last year. In the same period the previous year, the deficit was -135 million euros, almost half of the previous year's figure.

Contradiction in Economic Theory

Theoretically, a worsening current account deficit should lead to the depreciation of the local currency and vice versa. In 2024, the opposite has occurred. The lek has strengthened while the current account deficit has worsened. The behavior of the current account deficit and exchange rate (see graph: Current Account Deficit and Average Lek/Euro Exchange Rate in the First Quarter) explains the strengthening of the lek only in the period 2022-2023, when the current account deficit showed signs of improvement.

Rapid Reversal of the Current Account Balance

The current account balance has undergone a rapid reversal compared to last year, when the deficit reached its lowest historical level. In the third quarter of last year, the balance even turned positive. The increase in the deficit is mainly due to the deepening trade deficit in goods, which this time was not sufficiently balanced by the positive balance of services and secondary income.

For the first quarter, the trade deficit in goods reached a record value of 1.24 billion euros, a 39% increase compared to last year. While imports increased by 18%, exports of goods fell by 20%.

Trade and Services Balance

The trade balance in services continued to improve, but to a small extent. The surplus in the services account reached 629 million euros, an increase of 11.5% compared to the first quarter of last year. The main contributor to the services account was again tourism, which brought net income of 267 million euros, a 41% increase compared to the first quarter of last year.

Other Service Sector Challenges

However, the high growth rates of tourism income were not enough to fill the large gap in the trade of goods. This is also because other service account items, such as the processing industry or other services, saw a decline in income compared to a year ago. In particular, income from services for the processing of physical inputs owned by others (the processing industry) fell by 3% compared to the first quarter of last year.

Positive Effects from Secondary Income

A positive effect in the first quarter also came from secondary income, which consists mainly of remittances from emigrants. The value of remittances during the first quarter reached 242 million euros, an increase of 13% compared to a year ago.

Foreign Direct Investment

Despite the significant expansion of the current account deficit, the financial account, and especially foreign direct investments, continue to bring considerable inflows, which in the first quarter compensated for most of the current account deficit. Foreign direct investments amounted to 354 million euros, which is 95% of the value of the current account deficit.